Ain subparagraph fiii i by substituting for the words years of assessment 2021 and 2022 the words years of assessment 2022 and 2023. The appropriate percentage for subsequent tax years.

Hisbah As A Consumer Protection Institution In Malaysia A Special Reference To Islamic Consumer Credit Industry Emerald Insight

The Finance Act 2021 the Act has been gazetted on 31 December 2021 with no material difference from the Finance Bill 2021.

. The above has been enacted under the Finance Act 2020 and gazetted on 31 December 2020. The Act and KPMGs earlier highlights on Finance Bill 2020 can be accessed via the above header links. This Act may be cited as the Finance Act 1994.

The tax measures in the Finance Act are substantially similar to the tax provisions as provided in the. Personal allowance from 2016. Where there is a loss on the sale of the goodwill the loss is calculated as proceeds less cost and is treated as a non-trading as opposed to a trading debit.

Personal allowances for 2015-16. The rate of 12 is paid on earnings between 9500 per year and 50000 per year and the rate of 2 is paid on all earnings over 50000 per year. For the tax year 2020-21 the rates of employee class 1 NIC are unchanged at 12 and 2.

Commencement of amendments to the Petroleum Income Tax Act 1967. Increase in income tax exemption on compensation for loss of employment. Finance Act 2021 effective date 1 January 2022.

2 Section 6 has effect for the year of assessment 2019 and subsequent years of assessment. The Finance Act 2020 Act obtained the Royal Assent on 31 December 2020 and was published in the Gazette on the same date. The Act KPMGs highlights on Finance Bill 2021 and further development on the Finance Bill 2021 can be accessed via the above links.

Our highlights are intended to provide a general overview of the. The Act comes into operation on 1 January 2021. Charge and rates for 2015-16.

3 Sections 4 7 8 9 14 20 and 21 and paragraph 19a. The Act comes into operation on 1 January 2022. The Finance Act amends the Income Tax Act 1967 ITA the Promotion of Investments Act 1986 the Stamp Act 1949 the Real Property Gains Tax Act 1976 the Labuan Business Activity Tax Act 1990 the Service Tax Act 2018.

Charge for financial year 2016. Limits and allowances for 2015-16. Read a January 2022 report prepared by the KPMG member firm in Malaysia.

3 Sections 32 and 33 come into operation on 1 January 2017. On 27 December 2018 the Finance Act 2018 Finance Act was published in the Federal Gazette and takes effect from various dates. 1 Paragraph 31acomes into operation on the coming into operation of this Act.

Commencement of amendments to the Petroleum Income Tax Act 1967 30. Basic rate limit from 2016. This non-trading debit can.

CHAPTER II AMENDMENTS TO THE INCOME TAX ACT 1967 Commencement of amendments to the. 1 Sections 37 38 40 42 and 43 shall have effect for the year of assessment 2014 and subsequent years of assessment. The Finance No 2 Act 2015 has changed the rule for goodwill acquired on or after 8 July 2015.

The Finance Act 2020 the Act has been gazetted on 31 December 2020 with no material differences from the Finance Bill 2020. Unannotated Statutes of Malaysia - Principal ActsFINANCE ACT 2014 Act. National insurance contributions NIC Class 1 and class 1A NIC.

Commencement of amendments to the Income Tax Act 1967 3. Circular No 0132022 Finance Act 2021 - The Malaysian Bar. The Finance Act 2021 was published 31 December 2021 and the effective date is 1 January 2022.

1 Paragraph 5ahas effect from the year of assessment 2020 until the year of assessment 2025. CHAPTER 2 Income tax. Amendments of Acts 2.

The Income Tax Act 1967 Act 53 the Petroleum Income Tax Act 1967 Act 45 of 67 and the Stamp Act 1949 Act 378 are amended in the manner specified in Chapters II III and IV respectively. Under the new rules no tax deduction will be available for any amortisation or impairment of the goodwill. Finance 11 ii by substituting for the words one thousand ringgit the words two thousand ringgit.

Finance 33 2 Paragraph 31bhas effect for the year of assessment 2017 and subsequent years of assessment. The appropriate percentage for 2017-18. With effect from YA 2021 the income tax rate for resident individuals to be reduced by 1 for the chargeable income band of MYR 50001 to MYR 70000.

2 Sections 39 and 41 come into operation on the coming into operation of this Act. -- Please choose category-- Circulars Sijil Annual and Payments Benefits Practice Management Professional Development Opportunities for Practice Mentor-Mentee Programmes Laws BC Rulings and Practice Directions Resources Become a Member. Amongst others amendments were made to the Income Tax Act 1967 Act 53 the Real Property Gains Tax Act 1976 Act 169 the Stamp Act 1949 Act 378 the Petroleum Income Tax Act 1967 Act 543 the Labuan Business Activity.

Subsection 461 of the principal Act is amended.

Asia And The Pacific Report Idea Global State Of Democracy Report

Pdf Islamic Finance In The Metaverse A Meta Finance Framework For Supporting The Growth Of Shariah Compliant Finance Options In The Metaspace

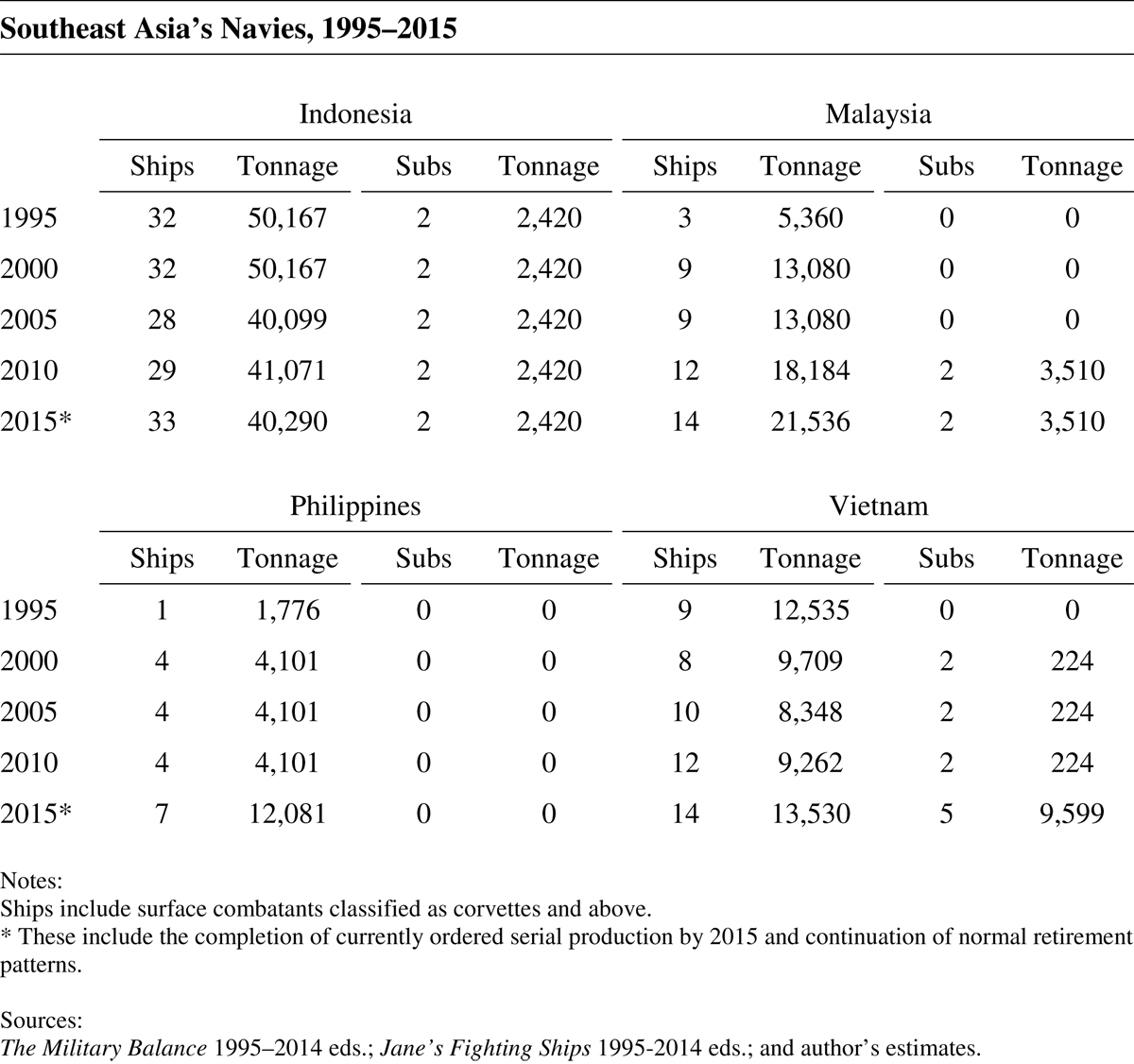

Comparative Southeast Asian Military Modernization 1 The Asan Forum

Strata Management Hand Over Timeline Developer Jmb Mc Lawyer Malaysia

Malaysia Market Profile Hktdc Research

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Thailand Financing Smes And Entrepreneurs 2020 An Oecd Scoreboard Oecd Ilibrary

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Malaysia Payroll And Tax Activpayroll

How To Become A Professional Technologist Utar

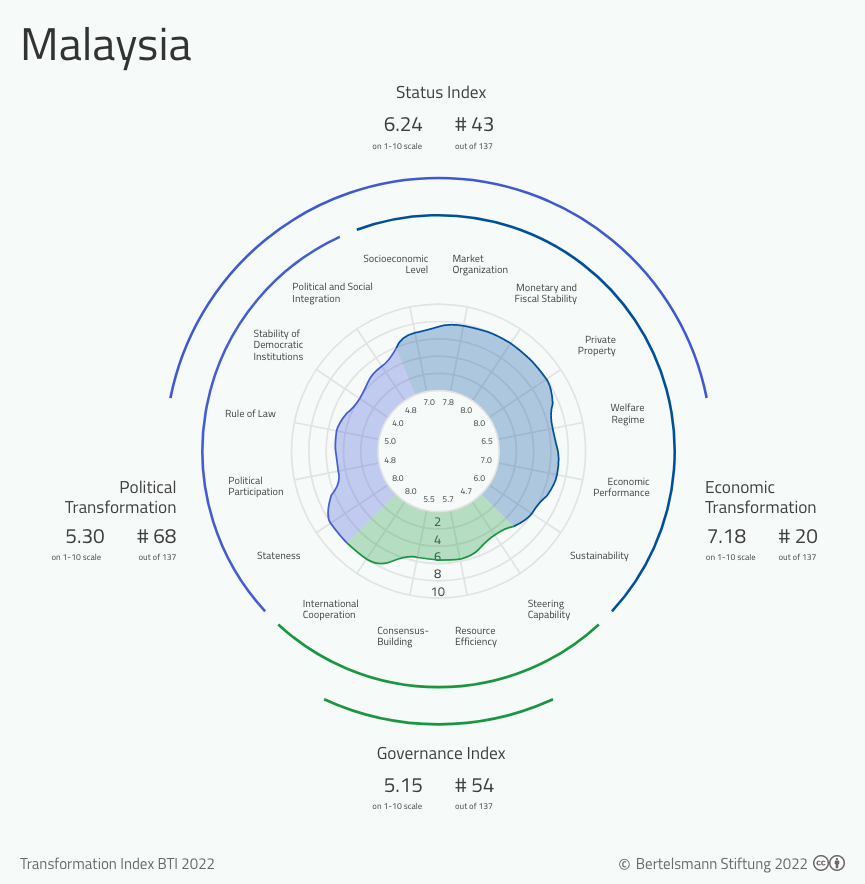

Bti 2022 Malaysia Country Report Bti 2022

Petronas Subsidiaries Seized As Lawyers Press 15bn Claim On Malaysia Financial Times